NEW FEATURE

Are You Leaving Money on the Table?

5 minute read

If you have multiple credit cards, you might not be getting the best rewards on your purchases. The average American owns 3.5 credit cards, each with its own unique reward structure—cashback, miles, points, and rotating bonuses. But keeping track of which card to use for what? That’s where things get tricky.

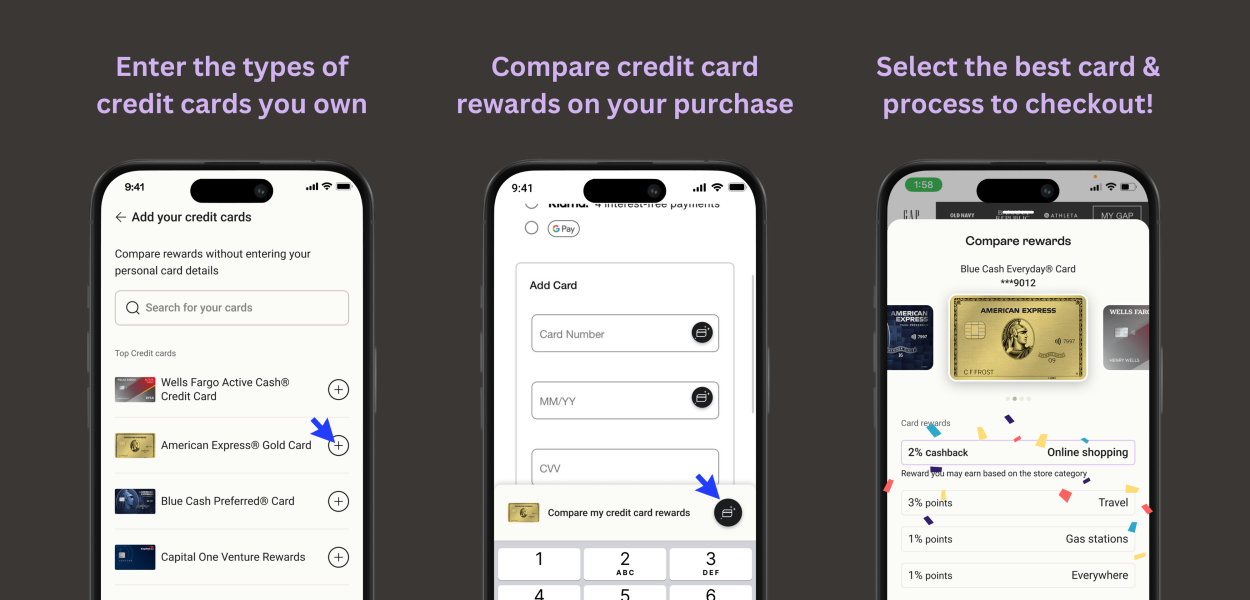

Introducing Karma’s Credit Card Comparison Feature

Karma is making it easier than ever to maximize your credit card perks. With our new Credit Card Comparison tool, you’ll know exactly which card to use at checkout to get the most benefits—whether it’s extra cashback on groceries, bonus points on travel, or the best perks for online shopping.

How It Works:

No more guessing. No more missed opportunities. Just smart, optimized spending in real-time.

Karma doesn’t just stop at credit card comparison. It has tons of money-saving features, like finding you coupons automatically, alerting you when prices drops, and comparing prices across different retailers. It works on every store you can imagine – from Amazon and Walmart to your favorite brands and even travel agencies. You’ll be amazed at how much you can save without changing your routine.

Why It Matters Which Card You Use

Using the wrong card could mean missing out on hundreds of dollars in rewards every year. With Karma’s Credit Card Comparison, you’ll always make the smartest choice—effortlessly.

Start maximizing your rewards today with Karma’s free tool.